By Tran Cong Quoc, bizconsult Law Firm

By Tran Cong Quoc, bizconsult Law Firm

In December 2018, the Government of Vietnam issued the Decree 163/2018/ND-CP (Decree 163), effective from February 2019. Decree 163 is said to be a radical reform of regulations on private issuance of corporate bonds in Vietnam, repealing the Decree 90/2011/ND-CP (Decree 90).

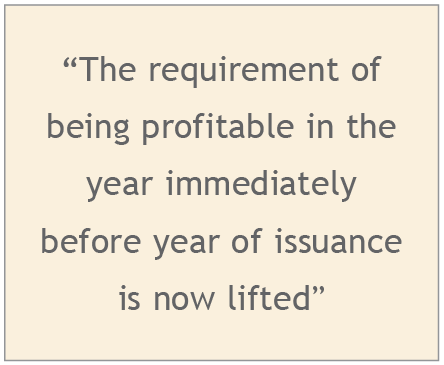

One of the most notable points under Decree 163 is that the requisite conditions for issuing corporate bonds have been significantly liberalised. Specifically, the requirement to be profitable in the year immediately before issuance is now lifted. The condition for a one-year test period before issuance shall be counted from the date of initial issuance of issuer’s business registration certificate, rather than the date of official operation as under Decree 90. In this regard, for issuers that have undergone restructuring such as merger, conversion or division, such time period before restructuring shall be taken into account for the purpose of that one-year test. Another noteworthy point is that a form of issuing by direct placement to bondholders without going through issuing agent or underwriter is now allowed for any issuers. Previously under Decree 90, it was limited for the credit institution only. With respect to international bonds, conditions requiring a credit rating for the issuer and legal opinion regarding issue have been revoked. Nonetheless, Decree 163 introduces a new condition for bond issues that requires an issuer to fulfil any outstanding due principal and interest accrued from those bonds issued in three consecutive years prior to the current issuance. Further, transferring of privately issued bonds upon issuance in the secondary market shall be, within the first year of issuance, restricted to the extent of 100 investors, excluding professional investors.

Decree 90 previously mandated an audited financial statement (FS) of issuer for the year immediately preceding the year of issuance as a condition for bond issuance. Should the bonds be issued in the first quarter of a year where a yearly audited FS has not been prepared, then the unaudited one shall be alternatively allowed, but to this end, that unaudited yearly FS must firstly be approved by the board of directors (for joint stock companies) or members’ council (for liability limited companies) in accordance with the charter of the issuer. However, the charter of companies in Vietnam do not usually regulate such power of board of directors or members’ council to approve the unaudited yearly FS for the purpose of bond issuance, leaving a legal uncertainty whether an issuer can use the yearly unaudited FS approved by its board of directors or members’ council for such purpose. Decree 163 now has relieved such uncertainty by stipulating that in such circumstance, an issuer may adopt the quarterly or semi-annual audited FS instead, thus no longer requiring the yearly unaudited FS.

Decree 90 previously mandated an audited financial statement (FS) of issuer for the year immediately preceding the year of issuance as a condition for bond issuance. Should the bonds be issued in the first quarter of a year where a yearly audited FS has not been prepared, then the unaudited one shall be alternatively allowed, but to this end, that unaudited yearly FS must firstly be approved by the board of directors (for joint stock companies) or members’ council (for liability limited companies) in accordance with the charter of the issuer. However, the charter of companies in Vietnam do not usually regulate such power of board of directors or members’ council to approve the unaudited yearly FS for the purpose of bond issuance, leaving a legal uncertainty whether an issuer can use the yearly unaudited FS approved by its board of directors or members’ council for such purpose. Decree 163 now has relieved such uncertainty by stipulating that in such circumstance, an issuer may adopt the quarterly or semi-annual audited FS instead, thus no longer requiring the yearly unaudited FS.

Remarkably, Decree 163 introduces a more systematic administration regime for corporate bonds as compared with Decree 90. In particular, the stock exchange shall now be the responsible state authority directly monitoring private corporate bond offerings in Vietnam, instead of the Ministry of Finance under Decree 90, which shall receive any statutory pre-issuance report, post-issuance report and regular and irregular information disclosure by the issuer in respect to the bonds issued. In addition, issuers shall be required to deposit issued bonds with a depository agent, ie the Vietnam Securities Depository (VSD) or a member of VSD, to manage the registrar and transferring thereof within 10 days from issue, and status of ownership of such bonds shall be updated by the depository agent to the stock exchange on semi-annual basis. The stock exchange shall establish and manage a corporate bond website to collect and publicise the information on international and domestic corporate bonds issued by Vietnamese issuers, which shall include, among others, information regarding bond terms and conditions, conversion of bonds, attached-warrant exercise and regular and irregular information disclosure of the issuers. Investors may log in to such website to search for the status of bond issues in accordance with the operation rules of such website which shall be issued by stock exchange down the road. The previously issued bonds shall also comply with such requirements on depositing and information disclosure under Decree 163 as from the effective date thereof.

Hanoi:

T: (84) 0) 24 3933 2129

F: (84) 0) 24 3933 2130

E: info-hn@bizconsult.vn

Ho Chi Minh:

T: (84) 0 28 3910 6559

F: (84) 0 28 3910 6560

E: info-hcm@bizconsult.vn

M: (84) 934 778 119

E: quoctc@bizconsult.vn

Bizconsult Law Firm

Bizconsult Law Firm Nguyen Anh Tuan

Nguyen Anh Tuan