January 3, 2024

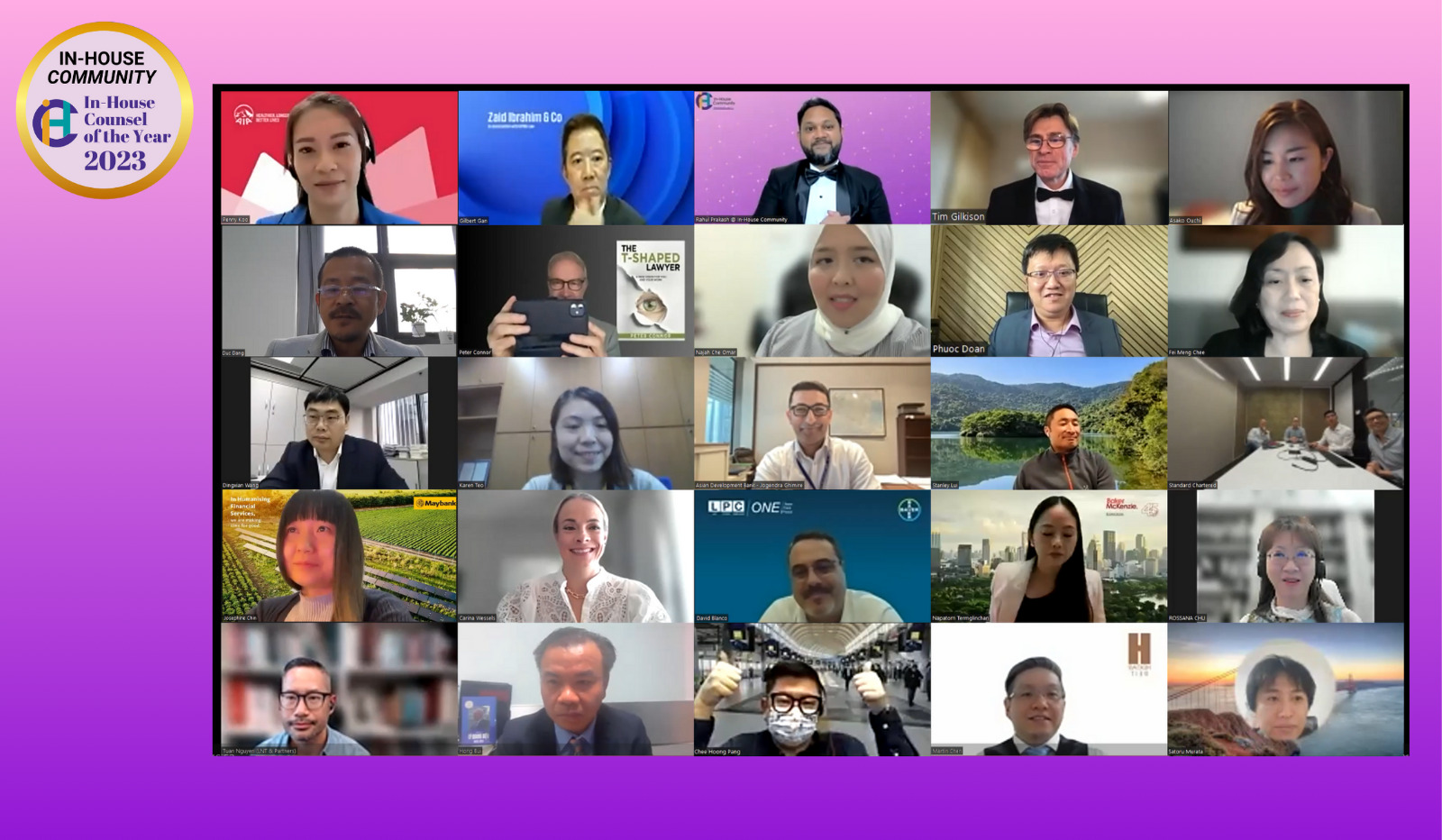

In a compelling display of resilience and adaptability, legal professionals convened virtually on 24 November 2023, for the second consecutive online IHC Counsel of the Year Awards ceremony. This event not only celebrated the outstanding achievements of legal professionals in South Africa, Asia, and the Middle East, but also cast a spotlight on the dynamic evolution of legal practice across the globe. Jump to the full list of award winners Rahul Prakash from In-House Community Rahul Prakash, publisher of In-House Community, set the stage with insightful remarks on the shifting landscape of the legal profession. He noted that, with the return of travel and the introduction of a new hybrid office model, the term “legal eagle” has taken on a new meaning. Prakash also reflected on a perceptible shift in the legal landscape over the past 18 months. Over this time, lawyers have been at the forefront of monumental tasks, ranging from overseeing large multi-jurisdictional deals to orchestrating comprehensive restructurings. Their role has extended beyond traditional boundaries, encompassing innovative process changes that have reshaped the way legal services are delivered. A common trend emerging is the significant digital transformation initiatives being undertaken across industries. Against this background, the 2023 In-House Community Counsel of the Year Awards are a true reflection of excellence and innovation, covering a spectrum of categories and illustrating the diverse nature of the profession. The awards included the prestigious In-House Industry Teams of the Year, Commended External Counsel of the Year, In-House Best Practice Management Awards, Corporate Social Responsibility (CSR), Diversity & Inclusion, Innovation, In-House Teams of the Year, and In-House Counsel of the Year. The... December 13, 2023

India Singapore UAE Vietnam Philippines China Thailand Malaysia South Korea In recognition of outstanding contributions and commendable service in external legal support, the Commended External Counsel of the Year 20233-2023 awards serves as a testament to the invaluable partnership between private practice lawyers and in-house legal teams. Selected through recommendations, votes and testimonials from the in-house counsel and other buyers of legal services in Asia and Middle East, this accolade highlights the crucial role played by these legal professionals in extending and enhancing the capabilities of in-house legal departments. Here are the Commended External Counsel 2022-2023, Hong Kong*. Rossana Chu LC Lawyers Rossana.Chu@eylaw.com.hk Rossana Chu is a Corporate Partner and has been in the corporate practice for more than 26 years. She handles engagements of different types such as M&As including takeovers and privatizations of Hong Kong listed companies, capital market transactions, corporate financing, asset management, ESG, corporate restructuring, regulatory compliance and employment issues. Rossana is an award-winning lawyer and profiled in various reputable international directories that highlight her historical achievements. Rossana is one of the two founders of the Association of Retired Elderly Limited, a non-profit-making organisation with a focus on improving the welfare of the elderly in Hong Kong. I am honoured to be recognised alongside the most senior and reputable lawyers in the legal industry. I could not have accomplished this achievement without the invaluable support of my clients and my firm. Thank you to In House Community for the award and IHC members for their nominations. Micheal Yau Eversheds Sutherland Maggie Kwok Harneys Sophia Man Baker McKenzie Vicki Liu Allen & Overy Ian Chapman Allen & Overy... December 13, 2023

India Singapore UAE Vietnam Hong Kong China Thailand Malaysia South Korea In recognition of outstanding contributions and commendable service in external legal support, the Commended External Counsel of the Year 20233-2023 awards serves as a testament to the invaluable partnership between private practice lawyers and in-house legal teams. Selected through recommendations, votes and testimonials from the in-house counsel and other buyers of legal services in Asia and Middle East, this accolade highlights the crucial role played by these legal professionals in extending and enhancing the capabilities of in-house legal departments. Here are the Commended External Counsel 2022-2023, Philippines*. Jude Ocampo Ocampo & Suralvo Jude is a Philippine attorney specializing in mergers and acquisitions, corporate law, and tax. He holds a Master of Laws degree from Harvard University, where he received the Ayala Scholarship Grant, the Lopez Scholarship Grant, and the Landon H. Gammon Fellowship for Academic Excellence. He also earned a Master of Business Administration degree (Finance and Supply Chain Management) from UNC-Chapel Hill’s Kenan-Flagler Business School, where he was a UNC Kenan-Flagler Fellow. He is a graduate of and a former professorial lecturer on tax law and constitutional law at the University of the Philippines College of Law. We in Ocampo & Suralvo Law Offices are grateful for again being recognized and commended by our clients. Enrique V. Dela Cruz Jr. Divina Law enrique.delacruz@divinalaw.com He graduated from UST – AB Legal Management (cum laude) in 1996, and Juris Doctor (with honors) in 2000, both as a full-university scholar. In 2001 he earned his Masters in Public Management degree from the Ateneo School of Government. In 2002, he completed a... December 13, 2023

Philippines Singapore UAE Vietnam Hong Kong China Thailand Malaysia South Korea In recognition of outstanding contributions and commendable service in external legal support, the Commended External Counsel of the Year 20233-2023 awards serves as a testament to the invaluable partnership between private practice lawyers and in-house legal teams. Selected through recommendations, votes and testimonials from the in-house counsel and other buyers of legal services in Asia and Middle East, this accolade highlights the crucial role played by these legal professionals in extending and enhancing the capabilities of in-house legal departments. Here are the Commended External Counsel 2022-2023, India*. Ashwath Rau AZB & Partners Haigreve Khaitan Khaitan & Co Abhishek Awasthi AZB & Partners Varoon Chandra AZB & Partners Pallavi Meena TT&A Gautam Saha TT&A Cyril Shroff Cyril Amarchand Mangaldas Apeksha Mattoo Trilegal Nikhil Naredi Shardul Amarchand Mangaldas Gautam Chawla Trilegal Anuj Shah Khaitan & Co Soumitra Majumdar JSA Alka Bharucha Bharucha &... December 13, 2023

India UAE China Singapore Vietnam Hong Kong Thailand South Korea Philippines In recognition of outstanding contributions and commendable service in external legal support, the Commended External Counsel of the Year 20233-2023 awards serves as a testament to the invaluable partnership between private practice lawyers and in-house legal teams. Selected through recommendations, votes and testimonials from the in-house counsel and other buyers of legal services in Asia and Middle East, this accolade highlights the crucial role played by these legal professionals in extending and enhancing the capabilities of in-house legal departments. Here are the Commended External Counsel 2022-2023, Malaysia*. Deepak Sadasivan Adnan Sundra & Low deepak.sadasivan@asl.com.my Deepak has been extensively involved in corporate work including acquisitions, listings, joint ventures and corporate restructuring exercises, as well as corporate and commercial litigation. Since 1999, he has been primarily involved in capital markets and finance work, and has advised extensively on numerous transactions involving project finance, Islamic finance, derivatives, structured finance and securitisation. He was the managing partner of the Firm for over a decade and during his tenure, the Firm was privileged to have received various awards and accolades from inter alia International Financial Law Review, Islamic Finance News and Asian Legal Business. He is individually ranked as a Band 1 lawyer in Banking & Finance and Islamic Finance by Chambers & Partners, as an Elite Practitioner in Banking & Finance by Asialaw Profiles, and as a Hall of Fame lawyer in Banking & Finance, Capital Markets and Islamic Finance by the Legal 500. Gilbert Gan Zaid Ibrahim & Co (a member of ZICO Law) gilbertgan@ziclegal.com Gilbert is the Managing Partner of Zaid Ibrahim... December 13, 2023

India UAE South Korea Singapore Hong Kong China Malaysia Vietnam Philippines In recognition of outstanding contributions and commendable service in external legal support, the Commended External Counsel of the Year 20233-2023 awards serves as a testament to the invaluable partnership between private practice lawyers and in-house legal teams. Selected through recommendations, votes and testimonials from the in-house counsel and other buyers of legal services in Asia and Middle East, this accolade highlights the crucial role played by these legal professionals in extending and enhancing the capabilities of in-house legal departments. Here are the Commended External Counsel 2022-2023, Thailand*. Napatorn Dasananjali Termglinchan Baker McKenzie napatorn.termglinchan@bakermckenzie.com Napatorn is active in the consumer goods and retail and healthcare and life sciences industries, as well as investigations, compliance and ethics and mergers and acquisitions practices. She has advised numerous multinational clients on their operations in Thailand. She regularly advises on issues relevant to foreign investors, such as compliance, foreign investment, consumer protections, mergers and acquisitions, and corporate structures. Napatorn is particularly fluent in advising on legal issues surrounding licensing and approval requirements for consumer products and requirements of e-commerce and multi-level marketing businesses in Thailand. She is also experienced in corporate investigation work, particularly corporate fraud and misconduct. I am truly honored to be recognized by clients, colleagues and the in-house community for this award. I share this award with the strong Baker McKenzie team and look forward to continuing delivering services of highest quality to our clients Samata Masagee DLA Piper Kudun Sukhumananda Kudun & Partners Weerawong Chittmittrapap Weerawong C&P Stephen Jaggs Allen & very Arkrapol Pichedvanichok Chandler MHM Thanathip Pichedvanichok Thanathip & Partners... Upcoming Events

Recent Past Events