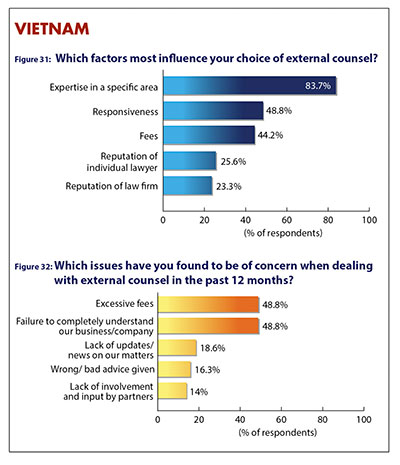

As is the case in many of the more mature markets in the survey, Vietnam boasts more respondents in the Financial Services sector (30.2 percent) than any other, with second place going jointly to Fast-Moving Consumer Goods and Technology, Media and Telecommunications, both with 14 percent representation. Counsel employed by Real Estate/Construction and Life Sciences companies are each represented by 9.3 percent, while Energy/Natural Resources and Manufacturing were tied sixth-highest at seven percent. Team size Though there was a lower percentage working alone last year (15.2 percent), the prediction last year – that all teams would either remain the same size or grow (50 percent believing their teams would grow, 50 percent expecting them to stay as they were) – may still have been correct, as this year’s survey could include newly-found legal departments, employed by businesses that previously only outsourced legal work. This year, fewer (28.6 percent) foresee growth, 69 percent expect their teams to sustain and 2.4 percent anticipate shrinking. Control of headcount and wanting to stabilise the business were the main reasons respondents said their teams would remain as they were, many wanting to level off after recent expansions. Those expecting a higher quantity of in-house lawyers by the end of the year cited business growth and the fact that legal responsibility and risk had grown and would continue to do so. Many business expansions noted were on an international stage as well as a domestic one, showing the ambition of many of the jurisdiction’s companies. Recruitment Using legal recruiters (of which there are are few in Vietnam) and referrals from other in-house lawyers drew on 32.6 percent. Referrals from others within the company were a noteworthy fourth with 23.3 percent of the votes. KEY ISSUES AND CONCERNS Over the next year, respondents anticipate that the laws will continue to change as the jurisdiction evolves, and expect keeping up with the developments to be of considerable importance and demand a lot of their time. Some referred specifically to OFAC, EU and UN sanctions, and said that complying with these “without affecting our business” would be a challenge. Working with external counsel As would be expected in an emerging market, business expansion and venturing into new areas of law were the most common reason respondents claimed they would use external counsel more. Reasons people expected to use firms less were cost and an increased reliance on the in-house function, while those who said they would use external help about as much frequently stated that their businesses had recently plateaued in terms of expansion, as well as that they would only go out-of-house when necessary, and currently saw no reason for this. Expertise in a certain area are again the most important factor to in-house counsel in Vietnam, though even more so this year, as this was a top priority for 73.9 percent last year and is one for 83.7 percent this year – almost a 10 percent leap. Responsiveness (48.8 percent) and fees (44.2 percent) are the second and third-highest considerations, and sway far more people than the fourth-highest – reputation of an individual lawyer – which is persuasive according to 25.6 percent. (Figure 31) Issues that have raised concern for Vietnam’s In-House Community when dealing with external counsel, and therefore issues firms should work on if they want to differentiate themselves, are foremost excessive fees and failure to completely understand the business: problems found by 48.8 percent each. These were the two most significant drawbacks according to last year’s survey too. Subsequent concerns are a lack of updates (18.6 percent), wrong or bad advice given (16.3 percent) and a lack of involvement from partners (14 percent). (Figure 32) |

| Jump to FIRM OF THE YEAR result |

Back to survey home page |