Developments across the region are supporting the development of alternate dispute resolution mechanisms that will promote further investment into Asia’s fast-growing economy, writes Nick Ferguson.

Developments across the region are supporting the development of alternate dispute resolution mechanisms that will promote further investment into Asia’s fast-growing economy, writes Nick Ferguson.

It has been a long time coming, but Asia is slowly building the infrastructure needed to support the development of international arbitration.

Hong Kong and Singapore, in particular, are vying to become the leading regional seat and have both introduced new laws this year governing third-party funding, the development of which has been constrained due to uncertainty around the archaic common-law doctrines of champerty and maintenance.

The growth of arbitration during the past few years has prompted an effort to remove this uncertainty in line with other major arbitration jurisdictions. Hong Kong’s Arbitration and Mediation Legislation (Third Party Funding) (Amendment) Bill 2016 is expected to come before lawmakers later this year, while an amendment to Singapore’s Civil Law Act was adopted on March 1.

Both laws are only applicable to arbitration — and only to international arbitration in Singapore. And both cities have supported their new legal frameworks with codes of conduct aimed at third-party funders.

To throw light on this new area we spoke to Tom Glasgow, investment manager for Asia at IMF Bentham, a leading funder from Australia that is expanding in the region, about the environment for third-party funding in Asia. We also spoke to Katherine Yap, chief executive of Maxwell Chambers, about what it is doing to promote the development of Singapore as an arbitration seat.

While there has been progress in some areas, there have also been some setbacks. In the US, the Trans-Pacific Partnership (TPP) agreement would have significantly strengthened the role of international arbitration in investor-state disputes across Asia Pacific and the Americas. However, President Trump has killed off any lingering hopes that the troubled agreement might be successfully concluded.

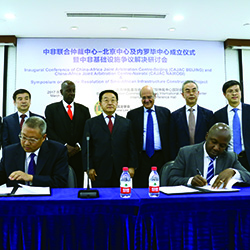

Dissatisfaction with such agreements is not confined to voters in the US. China’s frustration with the time and cost involved in resolving its disputed investments in Africa through traditional international arbitration centres has led it to create its own bilateral arbitration framework in the form of the China-Africa Joint Arbitration Centres. The first centres were established in Johannesburg and Shanghai in November 2015, followed this year by new centres opening in Nairobi, Beijing and Shenzhen in March.

The Beijing Arbitration Commission discusses the background to this initiative in the report.

Elsewhere in the region, the Thai Arbitration Institute issued updated rules in January covering interim measures, consolidation of related arbitrations and service by electronic means, while the Vietnam International Arbitration Centre made provision for expedited procedures and other improvements with a new set of rules adopted in March.

In the Middle East, Saudi Arabia formally opened the Saudi Centre for Commercial Arbitration in Riyadh last October, while Qatar enacted a new law in February aimed at promoting the growth of international arbitration in the country.

For more Dispute Resolution Special Report

Q&A – Katherine Yap, chief executive of Maxwell Chambers

Q&A – Katherine Yap, chief executive of Maxwell Chambers

Singapore’s Maxwell Chambers is an integrated dispute resolution complex housing best-in-class hearing facilities and support services, as well as top international alternate dispute resolution (ADR) institutions. …

Asian-mena Counsel speaks to Tom Glasgow, investment manager for Asia at IMF Bentham, about the environment for third-party funding in the region…

The role of arbitration in promoting Sino-African trade and investment

The role of arbitration in promoting Sino-African trade and investmentIn March, the Beijing Arbitration Commission/Beijing International Arbitration Centre (BAC) and the Nairobi Centre for International Arbitration (NCIA) formally founded the China-Africa Joint Arbitration Centre…