Published in Asian-mena Counsel: Deals of the Year 2019

By Nick Ferguson, In-House Community

Asian-mena Counsel’s review of the top transactions and matters that closed during 2019.

Before Covid-19 disrupted global markets, 2019 was a good year for dealmakers in Asia, with healthy growth across most of the region’s asset markets and many market-defining transactions that were helped over the line by some of the top legal advisers in the region.

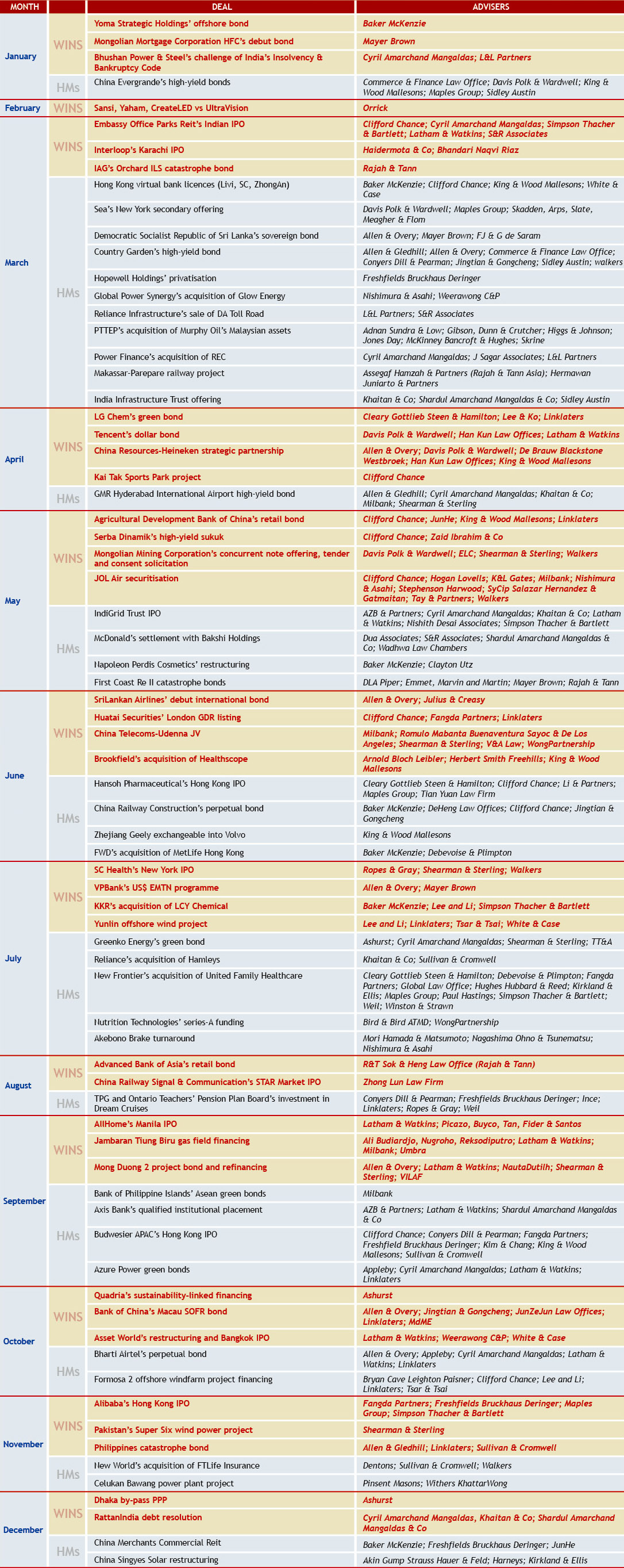

We review some of the stand-out transactions across all practice areas below. See the table for all the advisers on each of the winning transactions, as well as those that we have given honourable mentions.

BANKING & FINANCE

Asian businesses have been slow to embrace environmental, social and governance (ESG) targets, but 2019 saw significant progress, including a landmark loan facility arranged by ING for Quadria Capital, a private equity fund focused on South and Southeast Asia, with Ashurst advising. It is the world’s first sustainability performance-linked financing, linking the interest rate the US$65 million three-year revolving facility to the sustainability performance of the Quadria Capital Fund II. It is a small step, but one that is worth championing.

Digital banking is another area where Asia has lagged, despite the region’s high penetration of smartphones and a generally tech-savvy customer base. But Hong Kong made strides in the right direction in 2019 with the issuance of its first virtual banking licences to a number of new ventures, including Livi VB, SC Digital Solutions, ZhongAn Virtual Finance and Infinium (now Fusion Bank). The winning licensees were among 29 institutions that applied for the virtual banking licences from the HKMA.

A more conventional banking deal, though still a first of its kind, saw Milbank advise on the structuring of the first aircraft lease securitisation using equity from the Japanese operating lease market for Stratos and JP Lease. Complex and innovative, the US$683.2 million deal was used to acquire 15 securitized aircraft with leases attached (to Air Canada, Scoot, Qatar, FlyDubai, Gulfair, Air Asia, Malindo, Philippine Airlines, TACA, Brussels Airlines and Batik) from two separate sellers, GE Capital Aviation Services and Standard Chartered.

DEBT CAPITAL MARKETS

Size matters in judging our deal awards, but we’re also focused on complexity and innovation. It is certainly the case that banks and companies turn to top firms to get their most important deals done, and that’s why we tend to recognise the biggest deals of the year (even when they’re fairly vanilla), but opening new markets and introducing borrowers is where legal advisers can add real value.

Tencent’s US$6 billion bond was the biggest of the year and handled with aplomb by Davis Polk, but some of the year’s much smaller deals helped to develop the region’s frontier markets in significant ways.

For example, Yoma Strategic’s offshore bond raised just Bt2.22 billion (US$70m), but it was the first ever offshore bond from Myanmar, a country with no sovereign credit rating or benchmark government yield curve, and demonstrated Thailand’s emergence as a financial market for its frontier neighbours. Yoma got the deal done thanks to a guarantee from a multilateral facility established by Asean+3 and the Asian Development Bank, showing the way for other would-be borrowers in the country — and the region.

Other frontier issuers included SriLankan Airlines’ US$175 million debut international bond, a rare corporate issue from the country that investors welcomed with open arms. Thanks to US$3 billion of orders, the airline was able to price the deal at a very competitive 5.3 percent despite the modest size — a remarkable and much-needed achievement after a series of terrorist bombings disrupted tourism. We also recognised the country’s much bigger US$2.4 billion sovereign bond, but the development of the new corporate funding options is a more notable step (even if SriLankan Airlines had to rely on a sovereign guarantee).

Vietnam made similar progress in 2019 — VPBank’s US$1 billion medium term note programme and its subsequent US$300 million drawdown was the first corporate US dollar-denominated bond out of Vietnam in the past seven years.

In the region’s northernmost extreme, Mongolian Mortgage Corporation HFC, the only finance company licensed to issue asset-backed securities and the sole residential mortgage-backed issuer in the country, launched its debut US$250 million unsecured bond offering and subsequent tap issuance for an additional US$50 million.

It was a bumper year for high-yield issuance in general, and especially from China’s property issuers, including a US$3 billion deal for China Evergrande and US$1.5 billion for Country Garden, but the highlight of the year was perhaps Serba Dinamik’s US$300 million Islamic deal, which was the first US dollar high-yield sukuk in the region.

As seen in the banking and finance category, the growth of ESG is an increasingly important consideration for investors — and this has encouraged significant growth in the green bond sector as Asian borrowers seek to tap into this pool of liquidity. Bank of Philippine Islands issued the first US dollar-denominated Asean green bond by a Philippine bank and the country’s first rated green bond in the international market, while Bank of China. The region’s biggest green bond came from Greenko Energy, which raised US$950 million.

We also saw landmark retail bonds from Advanced Bank of Asia in Cambodia and from Agricultural Development Bank of China in Hong Kong.

Catastrophe bonds

A notable development in Asia’s debt market came in the form of catastrophe bonds. Singapore has made a significant push to establish the city as a regional centre for insurance-linked securities and that plan came to fruition in 2019 with a series of ground-breaking cat bonds.

IAG’s Orchard ILS became the first special purpose reinsurance vehicle licensed by the Monetary Authority of Singapore under its new rules and successfully transferred A$75 million (US$52.7m) of exposure to investors. This was followed later in the year by First Coast Re’s US$100 million deal, which represented the first Rule 144A catastrophe bond issuance in Singapore.

However, neither of these deals were linked to risks in emerging Asia, where the need for disaster funding is most acute. That development came with the World Bank’s Philippines deal in November, which was the first cat bond listed on an Asian exchange and the first to be sponsored by an Asian sovereign. The bonds finance up to US$225 million of protection against three years of typhoon and earthquake risks, and will form an additional layer of disaster relief for the catastrophe-prone country.

EQUITY CAPITAL MARKETS

Alibaba’s HK$101.2 billion (US$12.93bn) Hong Kong IPO was impossible to ignore in 2019. It was the world’s second-biggest equity offering of the year and the biggest IPO in Hong Kong since 2010, and it also represented a significant achievement for the city’s stock exchange after Alibaba chose New York ahead of Hong Kong in 2014 for its first overseas listing. The introduction of dual-class shares was needed to woo Alibaba back — a decision that divides opinion, with investors generally complaining that the dilution of their voting rights is a blow to corporate governance, while entrepreneurs argue that such structures encourage innovation. It remains to be seen which view is correct.

Hong Kong’s IPO market has long been one of the world’s most active, but we also saw some activity at the other end of the scale in 2019, when Pakistani sock maker Interloop raised PRs5 billion ($51m) through an IPO in Karachi. It is the country’s biggest private-sector offering to date and the only one in 2019.

Alibaba might have come back to Asia, but international capital remains attractive, as demonstrated by Huatai Securities’ landmark London listing of global depositary receipts (GDRs), representing its Shanghai-listed A shares in London. It is the first Chinese company to sell such GDRs in London and the US$1.69 billion transaction was the first to be conducted under the new Shanghai-London Stock Connect scheme, which was set up to link the Chinese and European capital markets by providing fungibility between London and Shanghai-listed securities.

This wasn’t the only deal that tapped a new pool of international liquidity. SIN Capital raised US$173 million in New York through the IPO of a special purpose acquisition company, SC Health, which is a structure used to raise money for acquisitions — the first time for a company from Southeast Asia.

Listing overseas is not the only route to raising international capital, of course. Many institutions in the US are comfortable investing in Asia’s domestic markets through Rule 144A deals, but the extra time and expense involved with getting the necessary 10b-5 opinion can be an obstacle, which is one reason why there hasn’t been one from the Philippines for seven years. That changed in 2019 when AllHome raised P14.9 billion (US$295m) in the country’s biggest IPO since 2016.

We also saw India’s first real estate investment trust (Reit) listing from Embassy Office Parks Reit, the first H- to A-share IPO on China’s STAR Market from China Railway Signal & Communication and the biggest-ever US secondary offering from Southeast Asia with Sea’s US$1.55 billion deal.

DISPUTES

Complaints about patent infringement have been at the forefront of the US president’s trade war with China, which is why Orrick’s victory at the US International Trade Commission on behalf of three Chinese companies was such a notable success. Ultravision Technologies filed a complaint against Sansi, Yaham, CreateLED and a number of other respondents for alleged infringement of patents relating to certain modular LED display panels and components, but was forced to withdraw the complaint during the expert discovery period, ensuring a relatively speedy resolution and allowing the three companies to continue their expansion in the US.

Justice tends to be somewhat slower in India. McDonald’s has been at odds with its joint venture partner in northern India, controlled by Vikram Bakshi, since 2008 but only came to a settlement last year. The agreement gives McDonald’s India full ownership of the business for the first time since Bakshi introduced the golden arches to India in 1996.

M&A, PRIVATE EQUITY & VENTURE CAPITAL

China has been a tough market for international brewers such as Heineken. Despite years of investment, the Dutch beer is not a popular choice among Chinese drinkers and the company’s entire sales account for less than 1 percent of the market. That changed in 2019 with the company’s strategic partnership with China Resources, owner of Snow Breweries, which makes the world’s best-selling beer. As part of the strategic partnership, Heineken paid HK$24.3 billion (US$3.1bn) to become CRE’s 40% partner in the beer business and contributed its operating entities in China, including three breweries, into CR Beer for a total consideration of HK$2.4 billion. China Resources will also acquire a 0.9% shareholding in Heineken for €464 million (US$509m). Combined, these transactions resulted in a net investment of €1.9 billion and should create a significant rival in China to AB InBev, the maker of Budweiser and leading foreign beer.

The China Resources-Heineken deal was heavily negotiated and clearly involved a lot of lawyering, but it was not a competitive process, which provides a degree of freedom to work through issues. This was not the case with Canadian asset manager Brookfield’s US$3.2 billion acquisition of Healthscope in Australia, which was the result of a takeover battle with private equity player BGH Capital. It was also a complicated transaction in its own right, involving a simultaneous scheme of arrangement and takeover with a mixture of bank funding and funding from the disposal of part of Healthscope’s property portfolio.

KKR’s NT$45.32 billion ($1.83bn) acquisition of LCY Chemical was a less complex private equity acquisition, but a rare one for Taiwan. Indeed, it was the largest-ever private equity-backed transaction on the island and KKR’s first in 10 years.

Elsewhere around the region, deals that closed in 2019 included PTT group deals for Glow Energy in Thailand and Murphy Oil’s Malaysian assets, Cube Highways’ acquisition of DA Toll Road in India, and two Hong Kong insurance deals — FWD’s acquisition of MetLife’s business in the city and New World’s acquisition of FTLife.

On the venture capital side, one of the more interesting deals we’ve seen in the past few years was series-A funding for Nutrition Technologies, a Singapore startup that intends to build a factory in Southeast Asia that can produce more than 18,000 tonnes of insect-based feed ingredients and organic fertilisers every year as an alternative protein source with a lower environmental impact. Singapore is fast becoming a hub for agri-food tech startups and we look forward to more deals from this important sector.

PROJECTS

The development of wind power in Asia is one of the most promising developments in the region and took another step forward in 2019 with two significant projects. In Taiwan, German developer wpd closed a €2.7 billion (US$3b) project financing for the 640MW Yunlin offshore wind project, which is part of the government’s plan to install 5.5GW of capacity by 2025 as it seeks to reduce its reliance on nuclear power in the wake of the Fukushima disaster in Japan.

Later in the year, a smaller but perhaps more significant wind financing closed in Pakistan. The US$450 million IFC-backed Super Six deal provides funding for six wind power projects to be built in the Jhimpir wind corridor in Sindh province. It is a first-of-its-kind programme that will produce clean and low-cost power to meet the country’s critical demand for energy, and reduce reliance on expensive imported fossil fuels. With a combined capacity of 310MW, the Super Six plants will generate more than 1,000 gigawatt-hours of electricity a year and are expected to reduce approximately 650,000 tons of carbon dioxide emissions each year.

While such renewable projects are a very welcome answer to the region’s energy needs, there is still a place for fossil fuels given the region’s economic growth and increasing demand for energy. Renewables cannot realistically meet all of this demand, but replacing dirty coal plants with newer gas-fired technology is a proven way to lower emissions. The Jambaran-Tiung Biru Project in Indonesia is one such example, and is among the largest upstream oil and gas projects to reach financial close in the country in the past decade. It also featured several important new structuring techniques, including a trustee borrowing structure, and was the first project financing in the region to comprise conventional interest-bearing tranches with Islamic financing tranches. Containing extensive Indonesian participation throughout the structure, it is also the first oil and gas project financing in Indonesia to be supported by an all-domestic offtake, with no government support, solidifying the trend set by the 2017 Tangguh expansion project financing, which similarly featured a relatively high degree of domestic involvement. The project secured more than US$1.84 billion in debt commitments, split into conventional and Islamic finance tranches.

In Vietnam, we saw the first project bond issue and first IPP refinancing, in relation to the Mong Duong 2 power plant. The bond raised US$678.5 million while the senior secured loan facility raised US$402.7 million for the purpose of acquiring all of the outstanding project financing loans of AES Mong Duong Power Company.

Away from energy, the race to become the third new major player in the Philippines telecommunications industry was won by a consortium of China Telecoms and Udenna after a competitive and challenging bidding process. China Telecoms was required to meet a number of commitments within a short period of time after the declaration, but the hard work was repaid with the rare opportunity to launch a nationwide greenfield telecom project in a country with a population of more than 100 million. Such deals do not come along very often.

In Bangladesh, the Dhaka by-pass project will upgrade one of the main transport routes in the country through a public private partnership signed between the Roads and Highways Department and the winning consortium of Sichuan Road & Bridge, Shamim Enterprise and UDC Construction. The Dhaka By-pass project is a key element of RHD’s road strategy and essential to alleviating congestion in Bangladesh’s rapidly growing capital.

Not all projects are for such critical infrastructure. Hong Kong’s former airport site at Kai Tak has been mostly vacant since shortly after the handover in 1997, so New World Development’s award of a 25-year contract to design, build and operate the Kai Tak Sports Park was a welcome step towards redeveloping the former north apron. The HK$29.99 billion (US$3.8b) deal followed a tendering process that started more than 18 months earlier and culminated with a groundbreaking ceremony officiated by the city’s chief executive, Carrie Lam. It is the biggest sports infrastructure project in Hong Kong in decades and will include a 50,000-seat stadium with retractable roof that will eventually host the city’s iconic rugby sevens tournament.

RESTRUCTURING & INSOLVENCY

Mongolian Mining Corporation’s concurrent note offering, tender and consent solicitation represented the final stage in the company’s rehabilitation after its restructuring in 2017, and while the refinancing itself is not strictly a restructuring deal, we judged it to belong in this category more than anywhere else. The deal comprises a US$440 million bond sale, concurrent tender offer for up to US$50 million of MMC’s outstanding perpetual securities and concurrent tender offer and consent solicitation for any and all of ER’s outstanding senior notes due 2022. Outside China, it is the first successful refinancing for a debt-restructured company in Asia.

Another deal that represented the successful conclusion of a corporate restructuring was Asset World’s Bangkok IPO, which was the biggest new share offering in Thailand since 2013 and the first to jump straight on to the benchmark share index. Indeed, with a total market capitalisation of Bt185.74 billion (US$6.14b), it is the largest listed company in the history of Thailand to date.

Finally, in India, RattanIndia Power (RIP), RattanIndia Infrastructure and RR Infralands settled the Rs80 billion (US$1.13b) owed by RIP to its lenders, led by a consortium led by Power Finance Corporation and the State Bank of India. The process to find new investors was executed through a global Swiss challenge auction to raise Rs40.5 billion. The first-of-its-kind transaction, in which foreign investors have replaced Indian lenders through a process of resolution outside the National Company Law Tribunal framework, opening new doors for fresh capital to flow into the distressed Indian power sector.

Methodology

We selected our winning deals this year based on submissions to the weekly Briefing newsletter that we received during the year. To make sure your deals are considered for next year’s Deals of the Year, please make sure to send your completed deal announcements to thebriefing@inhousecommunity.com.

_________________________________

From January to December, the Asian-mena Counsel Deals of the Year (Winners & Honourable Mentions.) Congratulations to all the in-house and external counsel who had a hand in making them happen!

Asian-mena Counsel Deals of the Year 2019 – Winners & Honourable Mentions (HMs)

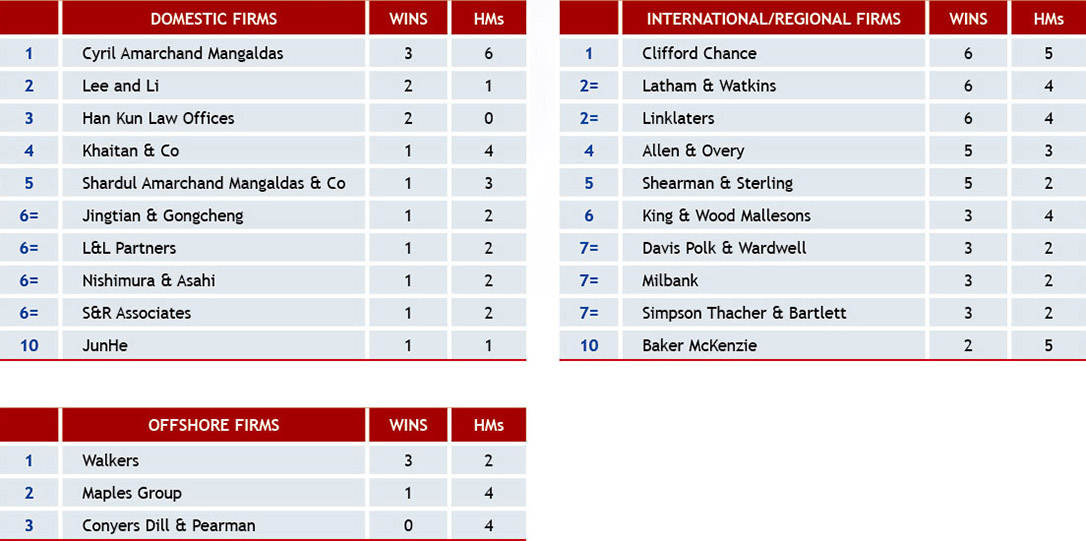

Asian-mena Counsel Deals of the Year 2019 – Top Advisers

![]() Click Here to read the full issue of Asian-mena Counsel featuring the Deals of the Year Report 2019.

Click Here to read the full issue of Asian-mena Counsel featuring the Deals of the Year Report 2019.

Don’t forget, you can keyword/name search our weekly Deals Archive here.

Don’t forget, you can keyword/name search our weekly Deals Archive here.

Sign up for the Asian-mena Counsel Weekly Briefing here.