The fundamental question in determining how your in-house life will go is how your department is viewed by management. Credit: David Lawrence

By David W Lawrence, Pisut & Partners

The In-House Dream

I never dreamed of going inside, it seemed boring and routine to me and, as a rain-maker with a litigation background, there didn’t appear to be much use for those skill sets on the inside. The oft regaled “work-life balance” achievable only by those on the inside, hadn’t yet entered my lexicon. But they threw buckets of money at me, so why not give it a shot?

While my experience confirmed my suspicions that I’m a private practice kind of guy, my preconceived notions of in-house life were blasted to bits and I have a lot more respect and consideration for what these lawyers go through. Not to say I wouldn’t ever consider another in-house counsel (IHC) role, but it would need to be pretty special to pull me away from my private practice comfort zone again.

Far and away, the most enjoyable aspect of my time as IHC was the opportunity to hang out with other IHCs across many different sectors, industries, locations, nationalities, cultures, structures, and backgrounds. Living a life where every IHC I met didn’t immediately assume I was trying to get them to hire my firm allowed me to gather data about how my fellow IHCs were compensated, living and experiencing work inside their organisations (quality of life or QOL), informally over those few years.

Takeaway #1: IHC QOL Depends on How Management Views and Values Legal.

The purpose of this article is to allow lawyers considering the move in-house to do what I didn’t and is based upon anecdotal information gathered informally over a few years:

- Anticipate what they’ll be in for;

- Find a good fit for them; and,

- Dispel any thoughts of a monolithic in-house dreamworld.

The IHC QOL Metric: Cost -> Value -> Strategic

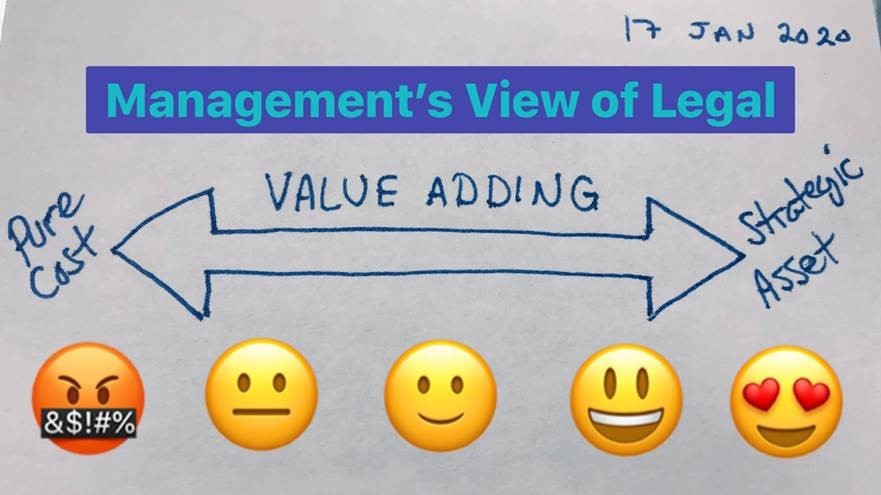

Those few years of gathering information allowed me to put IHC along a single-axis spectrum, based upon the management’s view and treatment of in-house departments, which ranged from “pure cost” through “value adding” to “strategic asset” (see the above image).

Strategic Asset. By way of a few examples, one lawyer I met from a global OTA (online travel agent) described how he was essentially treated like royalty within his organization. None of his requests for resources (legal tech, staff, subscriptions, outside counsel) were even questioned, much less denied. He reported directly to the CEO and spent copious amounts of time with the C-Suite, who took an active, yet hands-off interest in what his department was up to and sought his advice on strategic decisions for the company. I didn’t need to broach the issue of what he was being paid once the valet dropped off his Ferrari (joke!).

Pure Cost. On the other end of the spectrum, another lawyer worked for an industrial company which often generated annual losses due to the volatility of commodity pricing and paper-thin margins on their products. The organization limped along and was constantly under cost and staffing reduction mandates from management. The legal department reported to an individual, who in turn, reported to the CFO. Most of the team members who weren’t downsized, left. Hours increased, workload increased – and no quarter granted in the boardroom. Westlaw was discontinued, despite expanding into new markets. External counsel requests were treated as terrorist threats.

Value Adding. The “rest of us” end up working for companies that fall somewhere along the spectrum. A team, a voice, and access to resources. And it’s for the rest of us that the below questions can provide a few more insights as to IHC QOL:

Question 1: Does Legal report to the CEO or CFO (do you have a CLO?)?

CEOs lead organizations toward their vision, strategy and mission, CFOs ensure they have the money to do so. When GC’s report to CFOs, as they do in many organizations, the conversation is about cost. When GC’s report to CEO’s (ideally [???] a lawyer CEO – as there are many of them), the conversation is much different. Generally speaking, IHC’s in the CEO reporting line have better access to resources, board and decision making. It is a clear signal that your department is – at the least – well in to “Value Adding” and possibly viewed as a “Strategic Asset” within the organization. Of course, if you have a CLO, that’s going to be a good sign.

Question 2: Does the GC have a seat on the Board?

Initially, it is important to note that regional corporate cultures vary as to whether they put general counsels on the board as a matter of course or for a special purpose. Generally speaking, having the GC on the board will bring more information and work to the in-house team, as well as providing an enhanced ability to garner resources by having a seat at the table. If your GC is on the board, you’re in “Value Add” territory.

Question 3: Does the Company’s business generate a wide profit margin on its products and services (nb: but how is it performing?)?

Profit margins are simply the difference between the amount someone charges for a product or service and the total cost to make it. In short, wider profit margins mean more flexibility in allocating resources – more cash to throw around and more of a chance that some of it will land on your desk (okay, in your department’s budget). But a wide profit margin doesn’t mean a company is profitable! Always make sure your potential employer is not teetering on the brink of financial disaster unless you’re being hired on a project basis to “Meet Joe Black” or guide them through another type of exit from the market. Wide margins mean “Value Add”.

Question 4: Does the Company operate in an established or emerging industry and what is its position in its industry?

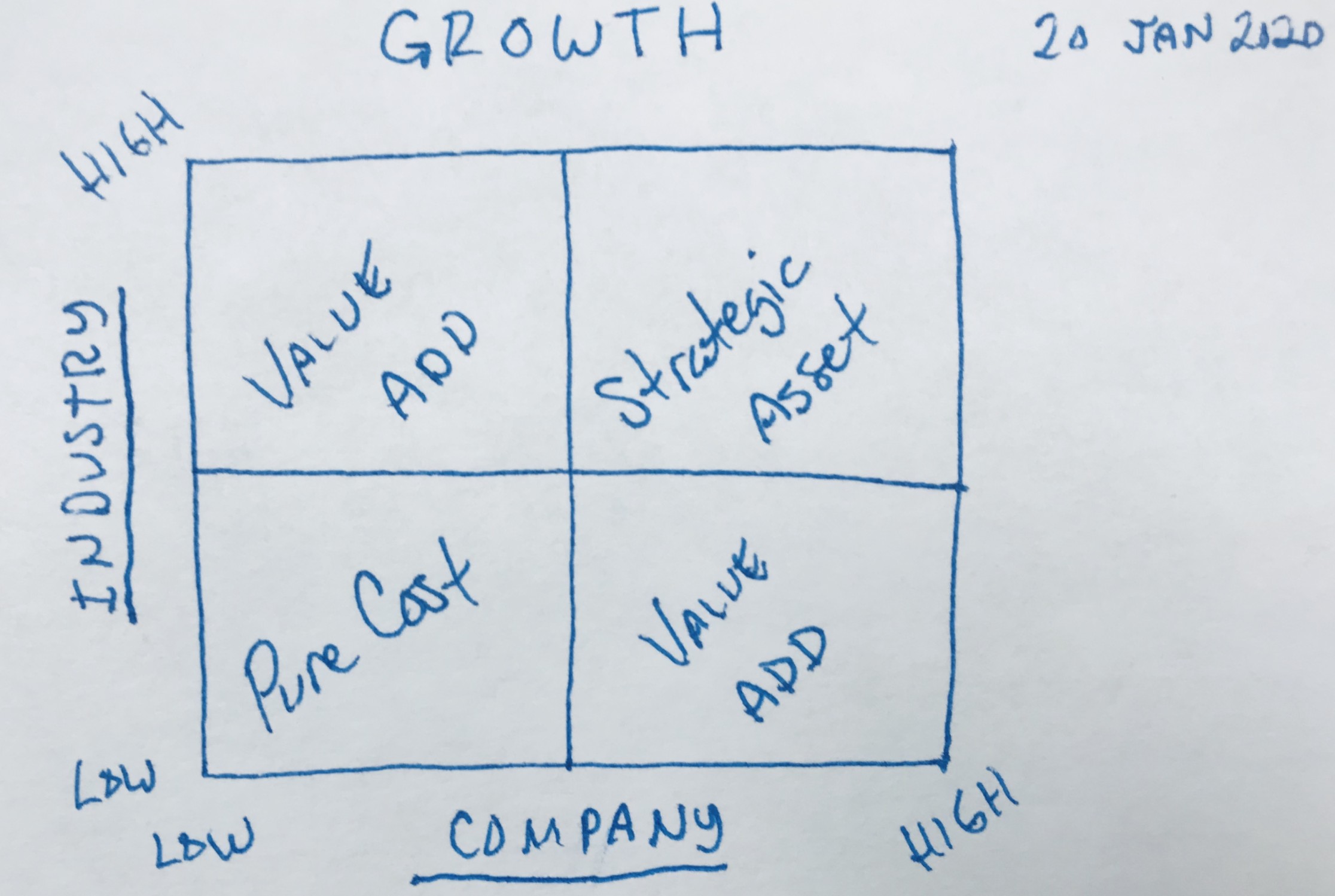

Established companies in established industries don’t often face new and exciting legal issues. The legal work is routine and thus subject to heavy cost-reduction/efficiency pressures. I know of at least one company that based the KPIs of the legal department on the number of documents they produced! On the other hand, a fast-growing company in an established industry may value their legal department, especially if they are innovating or disrupting. For emerging industries where only fast-growing companies survive – they are often operating beyond the law (not outside of it, necessarily) and lawyers will play a key role in influencing legislation and policy. Think of the Ubers of the world. Welcome to “Strategic Asset” land. Further explained with the 2×2 matrix below:

Question 5: Does the Company focus on products or services?

This is simple – service providers value services more than manufacturers. This is almost a primal feeling, if you can’t touch it and use it for something, it is inherently less valuable. And there certainly is some truth to this – but let’s not wax philosophical – if you’re inside a service provider, you’re again in “Value Add” territory.

Wrap Up

For the above-stated reasons …

In conclusion, I hope this article is insightful and helpful for those who are looking to go in-house. For those for which this article is too late, at least you will be able to better analyze your sub-optimal decision to put a finer point on how bad you feel about yourself. I kid – I wish you all to be happy and become rich, in either order.

Please share your thoughts, corrections, agreements, experience and any of my mistakes or misconceptions. I can be found at: https://www.linkedin.com/in/attydwl/

A ‘return’ to private practice

Tim Gilkison spoke to three Asia-based lawyers about their return to private practice, and how to make a successful transition. >>>