Swedish teenager Greta Thunberg’s theatrical denunciation of world leaders so dominated news coverage of the recent UN Climate Summit in New York that other developments at the meeting slipped under many a radar.

For Africa, an announcement by the African Development Bank that it is making a surprise policy turn away from fossil-fuel investment and ploughing a new renewable energy path was of enormous significance — yet it mainly featured on business pages and hardly at all on mainstream broadcast media.

The BusinessLive website did carry an item headlined “African Development Bank drives US$500 million nail into coal’s coffin”. These are strong words, particularly given much of Africa’s reliance on coal-burning power, not to mention an abundance of coal reserves that has for decades been seen as the inexpensive power foundation on which to build the continent’s development.

Strong words, but probably prophetic. For climate-change worries are forcing a dramatic shift in the way the world views fossil fuels and the pollution they cause.

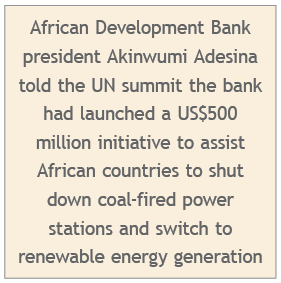

ADB president Akinwumi Adesina told the UN summit the bank had launched a US$500 million initiative to assist African countries to shut down coal-fired power stations and switch to renewable energy generation.

“Coal is the past and renewable energy is the future,” said Adesina. “For us at the ADB, we’re getting out of coal.”

The US$500-million “green baseload scheme” will be rolled out in 2020 and is expected to draw US$5 billion of further investment.

The ADB will have done its sums and looked closely at partner commitments, so everything points to a major shift in energy investment strategy in Africa — which has long been in a state of inertia on the matter.

The ADB is following the lead of other development and commercial banks across the world in extricating itself from fossil fuels and the greenhouse gas cloud that was starting to damage its brand value.

In South Africa, Nedbank and First Rand announced in the past year that they were cutting investment in coal power plants, while Standard Bank says it will only put money into coal projects that fall within strict emission parameters and only if they are in desperately poor countries that badly need power to lift people out of poverty.

Internationally, Deutsche Bank, US Bancorp, Barclays, Credit Agricole and a dozen other multinationals have been setting the trend

The writing was clearly on the wall for coal when mining companies — the ones making the most money out of it — started shedding their coal interests. In South Africa, mining giants Anglo American and South 32 have sold or are selling their coal operations, while, internationally, mega-miners Glencore, BHP Billiton and Rio Tinto are in retreat from the black stuff.

Of course, it’s not as easy as simply dumping coal — as much as the climate activists might say it should be. For example, South Africa’s state-owned power utility Eskom relies heavily on coal power and any transformation to renewables would be tumultuous and expensive. Plus, tens of thousands of unionised workers are involved in the mining and power plant matrix and the government is extremely sensitive about the political implications of such disruption.

But the change train is clearly rolling — and it isn’t being pulled by a coal-and-steam-driven locomotive.

____________________________

LEX Africa is an alliance of law firms with over 600 lawyers in 25 African countries formed in 1993. More information may be found on www.lexafrica.com.

T: (27) 11 535 8000