Nathan Smith.

US/China tensions aside, executives at HSBC must be counting their lucky stars.

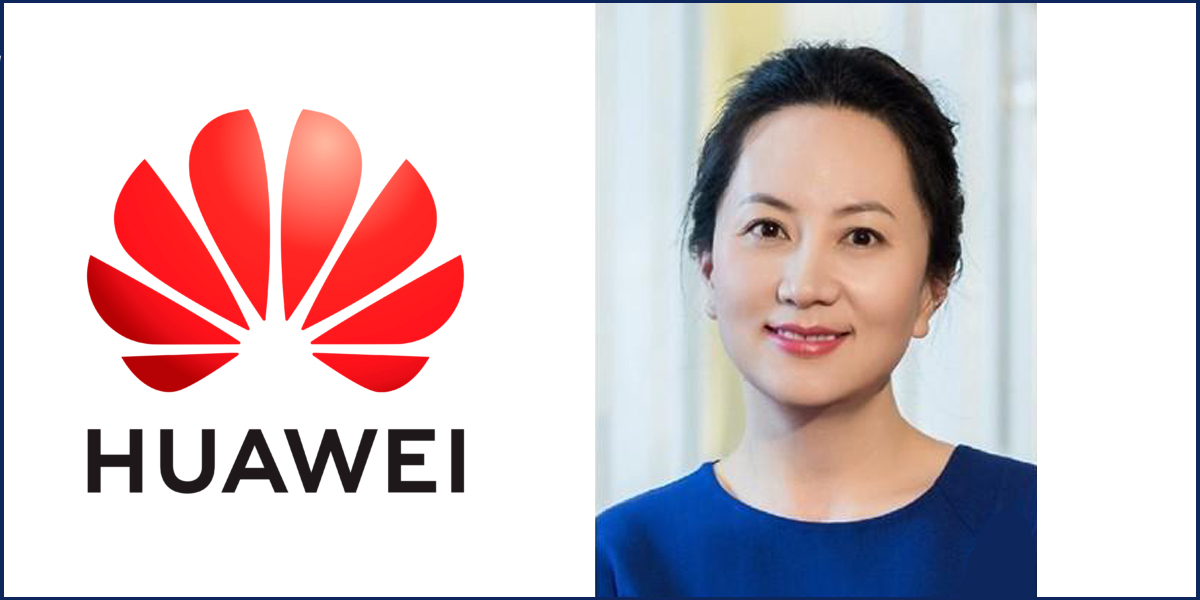

The latest drama in the extradition case against Huawei chief financial officer Meng Wanzhou began in June when a judge in Hong Kong, forced HSBC to release a trove of internal documents to bolster Meng’s claim that the bank knew about Huawei’s links with Iranian subsidiary Skycom.

But the documents didn’t create the effect which Meng’s legal team may have wanted.

The Canadian judge presiding over Meng’s extradition case to the US chose to keep the documents under seal which means they cannot be used in the case.

Extradition can be a drawn-out process at the best of times, and Meng’s case been sluggish for more than two and a half years. Outside of some legal sector media outlets, the case has largely dropped off the international radar.

So, some quick context of her case is in order.

A history of trust

On December 1, 2018, Canadian officials, acting at the request of the US Justice Department, arrested Meng Wanzhou at the Vancouver International Airport.

Meng’s arrest was made pursuant to an indictment which charged Huawei, its US subsidiary Skycom Tech and Meng with various counts of bank fraud, wire fraud, violation of US sanctions against Iran, related conspiracy charges and a healthy topping of obstruction of justice for good measure.

The US alleges Meng committed bank fraud in the US when she misled an HSBC executive at a 2013 meeting in Hong Kong in which she showed a PowerPoint presentation that described Skycom as “controllable” by Huawei in an effort to cover up prohibited transactions with Iran entities.

Her actions at that meeting may constitute bank fraud, the US claims. Breaching US sanctions is not an extraditable offence in Canada, but fraud is.

Ever since her arrest, Meng has been confined to her mansions in Vancouver – although with a home-detention ankle monitor – where she awaits a decision by the courts about whether her next aircraft ride will be to China or New York.

Meng’s Defence

But using the documents belonging to an international bank to reinforce Meng’s claim of innocence – particularly those from the notorious HSBC bank – was a surprising strategy in the first place.

Even more surprising was Meng’s legal team’s trust that HSBC would share any document that might incriminate the bank. HSBC has been playing this shifty game for centuries and it wasn’t going to let this case hurt its operations.

Meng’s lawyers hoped the documents would show that because HSBC’s internal customer management system knew Skycom as part of the “Huawei Mastergroup,” then this proved the bank had institutional knowledge of the risk of continuing to do business with Huawei, which kept more than 100 accounts at HSBC, including accounts it controlled for Skycom.

The legal team’s strategy appears to have been to subpoena documents from HSBC, present the files to Canada’s extradition court, point out that HSBC knew of Skycom’s connection with Huawei and then Meng would walk free.

A key part of that strategy relied on evidence that HSBC’s senior executives knew about Skycom and Huawei. Yet looking through the email trails reveals only junior executives and one or two senior executives in the conversations. Not exactly a smoking gun.

Strange conversations

On the one hand, the documents do reveal HSBC knew about Huawei’s relationship with Skycom.

For instance, in early 2013, HSBC executives circulated a Reuters story dated December 30, 2012, along with a brief email message that said: “Please see below Reuters story on Huawei, self-explanatory. Most grateful if you could obtain an update from the company.”

Other emails suggest the executives were trying to understand the connection between Huawei and Skycom. “Do you know whether Skycom Tech. Co Ltd is related to the Skycom company mentioned in the Reuters articles?” said one email.

Another document shows HSBC’s reputational risk committee may have known about Meng’s role in Skycom before 2010. It produced a report in 2014 which said: “In response to the claims, Huawei advised HSBC that its shareholding in Skycom was sold in 2009 and that Cathy Meng (CFO Huawei) resigned her position on the board of Skycom in April 2009.”

The executives appear also to have known in early 2013 that Skycom was linked to Huawei, since the email chain called “Fw: Huawei – Skycom Tech Co Ltd” clearly outlined HSBC staff were talking with Huawei about closing the Skycom accounts.

Another email between HSBC employees shows Skycom’s director used a Huawei email address and, in on one email, an HSBC employee reiterated that Huawei said it will “try to comply with all sanctions,” adding “I am pretty much reassured on the issue.”

On the other hand, as Robert Frater, a lawyer for the Canadian government acting on behalf of the US, said even if some HSBC staff knew of Huawei’s dominance over Skycom, it doesn’t mean fraud didn’t occur – refuting Meng’s claims that both senior and junior HSBC employees knew.

“Fraud exists even if some people knew, that’s what the law says. There’s a distancing of Skycom and Huawei and the idea that everyone knew is not reflected in the paper they want you to look at,” Frater said.

Meng’s strategy failed, yet it is hard to see why her team thought it would work in the first place.

Recall that HSBC didn’t want the documents released at all until the Hong Kong judge forced the bank to hand them over. If HSBC had nothing to fear, why did it block the documents?

Without seeing the full contents of HSBC’s email servers – the bank generally runs a tight ship in terms of leaks – verifying if the bank’s senior employees knew about Huawei’s relationship with Skycom will likely be forever unavailable to history.

But HSBC isn’t called the “gangster bank” for nothing.

It gained that moniker in 2012 for laundering hundreds of millions in drug money with the Sinaloa and Norte del Valle drug cartels. The bank was also caught moving money for organisations linked to Al Qaeda and Hezbollah, helping countries evade international sanctions and aided countless people to hide their cash and avoid taxes.

With a history like this, Occam’s Razor suggests an answer for why HSBC was nervous about revealing its documents. The reason may not have been because people would get the wrong impression that senior executives were involved in sanctions-busting, but that people might get the right impression that such behaviour is so normal inside the bank that even its junior executives considered it normal to rubber stamp risky deals.

Meng’s case will resume in August. If the Huawei CFO is extradited to the US, the geopolitical shockwaves will be profound.

But right now, her case offers a rare chance to see the inner workings of a major international bank. No one can say for sure what HSBC’s executives knew and when they knew it, but one doesn’t have to be a bloodhound to sniff a culture of obfuscation at the legendary bank.

HSBC narrowly avoided becoming the story. Its executives will surely be breathing a bit more freely knowing the spotlight has passed – for now.