The following is a summary of Dentons’ Neil Cuthbert’s article that analyses the key risks associated with the development and implementation of large-scale international energy and infrastructure projects. It assumes that the project will be financed on limited recourse terms, by one or more bank(s) or financial institution(s). Specifically, it looks at what makes, or does not make, a project ‘bankable’ and how a project’s risk allocation must be adjusted in order to make it bankable.

Bankability means the acceptability to the lenders of a project’s overall structure, including parties, products, markets, legal regimes and contracted documentary terms, as a basis for raising finance for the construction and operation of a project on a limited recourse basis. ‘Limited recourse’ means the lenders to the project look primarily, but not necessarily exclusively, to the property, assets and revenues of the project as the primary source of repayment of their loans. The shareholders of a project that is financed on limited recourse terms would expect their liability for such loans to be limited to their equity in the project and other support or guarantees, typically but not exclusively, related to completion of the project that they have agreed to provide to the lenders. This is one of the main advantages for shareholders in raising limited recourse financing. Other advantages for shareholders might be balance sheet considerations and/or a desire on their part to share project associated risks with others.

The approach in this article is primarily to consider the risks associated with a project from the lenders’ perspective. It is axiomatic that many of these risks will also be of equal concern to shareholders. Indeed, in many cases, the interests of the lenders and shareholders will be aligned. What will not necessarily be aligned, however, is the respective appetites of the two to assume risk. The lenders, on one hand, will earn fees and interest for assuming such risks, whereas the shareholders will look for a return on their equity, which will be many multiples of the income that the lenders will expect to earn on their loans. It follows, therefore, that the lenders will have a considerably more conservative approach to evaluating these risks. The higher the shareholders’ expected return on investment, the more risk they will generally be prepared to assume. Also, as industry participants, the shareholders will have a much deeper understanding of the construction, operational, technological, marketing and other (non-financial) risks associated with the project, making them generally more comfortable with assuming these risks.

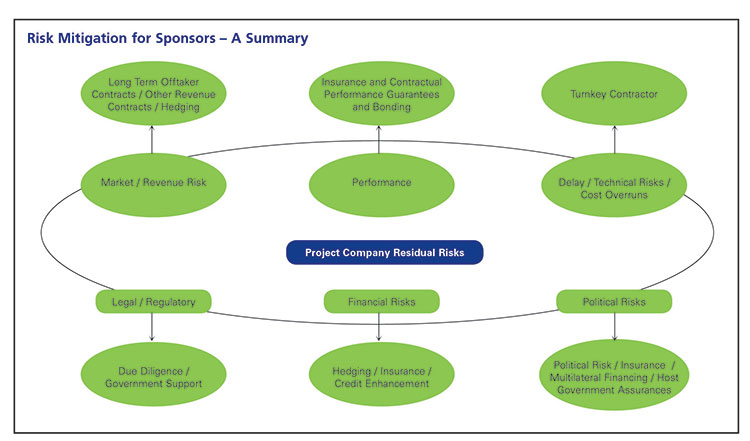

It is important to understand that the essence of limited recourse financing of a project is that the risks are allocated by the developer (or project company) to the party that is best able to manage and mitigate these risks. This provides the greatest opportunity to effectively manage and reduce these risks. An arbitrary allocation of risk or allocating a particular risk to a party that does not have the competence to understand and manage that risk will inevitably lead to problems. The end result of a carefully structured project utilising limited recourse financing should be that very little risk will be left with the project company. This is the ideal outcome for the shareholders, lenders and key stakeholders, as in reality, for most projects, the project company is essentially just a vehicle (often referred to as a special purpose vehicle or SPV) established to develop and operate the project by the shareholders and others, including the contractor, operator, suppliers, offtakers, technology providers and buyers, who will each assume pivotal roles in the successful development and operation of the project. If too many risks are ‘parked’ with the project company without support from other project parties the end result will be that the shareholders, to the extent of their equity (and guarantees, if any) and lenders will end up sharing the risk brought about by such default.

General bankability principles

Approach to risk sharing

The lenders will expect a fair and reasonable approach to the sharing of risk among the various project parties. How this will be achieved will, of course, depend on detailed discussions and negotiations between the parties but, broadly speaking, the optimal approach will be that each material individual risk should be allocated to, and assumed by, the party best able to manage that risk. The lenders will not accept risks arbitrarily being allocated to the project company as the project company is not in a position to manage or allocate those risks to other parties. As noted above, from the lenders’ perspective, risks that are ‘parked’ with the project company are, essentially, being assumed by the lenders, particularly in a default situation (and to a lesser extent, the shareholders).

Change in law

The lenders may require protection against changes in law that may have a material and adverse effect on the project or the project’s economics such that the risk profile of the project is changed in a material way. Where there is no specific government involvement in a project, the lenders’ recourse is likely to be limited to political risk or commercial insurance, which may offer some relief or recourse to the shareholders. However, where there is a significant government involvement in a project (whether as a sponsor or shareholder, concession grantor and/or perhaps fuel or utilities supplier) typically, the lenders will expect direct contractual commitments from the government under the concession agreement (if there is one) or a host government agreement (or similar arrangement). The scope of change in law protection that may be acceptable to a government will of course differ from project to project. Blanket protection for the project company against all changes in law that have a material impact on the project or the project’s economics would be rare. More typical is to share these risks and for the government to provide relief only against ‘discriminatory’ changes in law, that is changes in law that directly impact the project company (and not other companies) or other companies undertaking similar (concession) projects in the relevant country (and not other companies).

Equity contributions The lenders will require the shareholders to contribute an ‘appropriate’ level of equity to a project. What this appropriate level of equity is, will depend on many factors, including the risks perceived by the lenders in such project, whether the shareholders are actively participating in the project (e.g. as a contractor, operator or offtaker) and prevailing market conditions. Thus, for example, if a project has little active shareholder involvement other than through equity contributions and is a project that the lenders perceive to be at the higher end of the risk spectrum, then the lenders will likely require a higher debt-to-equity ratio for that project (say, 60:40 or even 50:50). Probably the starting point with most projects will be roughly 70:30 and this will be adjusted according to the particular project and market conditions. A related issue will be the timing of equity contributions. Typically, lenders will want equity to be injected into a project either up front or, possibly, on a pro rata basis with their loans during the construction period. Shareholders will prefer to back-end their equity. It is sometimes possible to bridge these different expectations through the use of equity bridge loans under which the project company borrows the equivalent of the equity contributions of the shareholders from commercial banks that are prepared to lend to the project company on an unsecured basis (but subordinated to the project loans) with the support of shareholder guarantees.Dividends and distributions The lenders will want to prevent shareholders from taking out dividends or receiving other distributions (whether in the form of equity returns or under management, services or similar contracts) from the project company before the lenders have been repaid. Such a position is not usually acceptable to most shareholders (except, perhaps, where it is accepted by the shareholders that the level of project risk is very high). The compromise is usually that the lenders will permit dividends and other distributions to be extracted once the project has been commissioned and has started repaying the loans; and even then, only so long as the key project financial cover ratios have been met, the debt service reserve account is fully restored, the project is not in default and possibly some further project-specific conditions or restrictions must be met. The timing of payment of dividends and distributions to shareholders can have a material impact on the shareholders’ return on equity and so these terms will be heavily negotiated between the lenders and shareholders. Where all or part of the equity has been contributed through a shareholder loan, similar restrictions will be imposed on the payment of interest or repayment of these loans to the shareholders. Related projects Finance risks Discrimination risks Early termination risks |

|

Construction risks

For most projects, the construction of the project is the time when it faces its most significant risks, certainly true for most infrastructure and utility projects. The most significant construction risks are cost overruns, delays and technology/commissioning risks. But there are many other risks associated with delivering a project on time and on budget. That is not to say there are no risks for a project once it’s commissioned and in operation. These can also be significant, particularly with projects that have multiple independent plants or trains where there are plants or trains in a process chain relying on others in that chain for raw materials or feedstock. The identity of the construction contractor will also be critical. As well as being an experienced and creditworthy contractor, in many projects the shareholders will want a turnkey solution with a single point of responsibility, and at the same time managing or reducing sub-contractor risks.

Conclusion

At the bottom of page 38 is a diagram highlighting the most common potential risks with any project, along with a possible mitigation measure.

While not all of these risks will be relevant to every project, many of them will be, and the shareholders, governments and other key stakeholders will need to structure the various elements of the project with the bankability requirements addressed in this article in mind.

In many (but not all) cases, the interests of the shareholders (and sometimes the governments) and the lenders, will be aligned in relation to these risks.

–––––––––––

Footnote:

1. A ‘grantor risk event’ might include events (other than natural force majeure events) that have been allocated to the grantor or are the ‘fault’ of the grantor, e.g. non-renewal of project permits, nationalisation, change in law, non-availability of utilities, non-renewal of project consents.

To view the full article Click Here