Neil Cuthbert and Atif Choudhary of Dentons analyse the emergence of public-private partnerships in the Middle East (with a focus on the GCC) and also in the context of selected emerging markets in Africa that have recently looked to introduce a PPP legal framework. Below is a summary of their full report.

Although governments and the private sector have a history of working together to procure energy, infrastructure and other projects in the GCC, they have largely done so in the absence of codified or other clear PPP legal frameworks of the kind seen in more developed jurisdictions.

With oil prices continuing to stall and without any obvious signs of recovery, and with fiscal deficits beginning to be seen across the region, governments in the GCC are looking to step away from their traditional reliance on oil revenues and sovereign reserves in order to continue with their ambitious plans for development. Populations continue to grow and require more sophisticated infrastructure and services, and increasing industrialisation and the recognition of the need or economic diversification all mean that the GCC nations are, like many others, looking to new methods of financing projects. Likewise in Africa, population growth remains staggeringly high and a continuation of budgetary limitations for governments also means that alterative methods for funding infrastructure and services needs must be found. It is becoming apparent that PPPs lie at the forefront of such alternative methods. In order to implement this change in direction, certain of the jurisdictions in the GCC and Africa already have, and other jurisdictions are in the process of developing, viable PPP legal frameworks. The rationale for this is not only to provide legal certainty for foreign investors who may be hesitant to invest heavily in markets with under-developed legal systems, but to set out clear boundaries in relation to matters which are important to all project parties, such as risk allocation and mitigation.

What will become increasingly clear throughout this article is that although each jurisdiction is at a different stage of developing its own PPP legal framework, there is a distinct political will and necessity to embrace the PPP model which has been largely successful in the wider international projects market.

References in this article to ‘projects’ or ‘PPP projects’ (which are used interchangeably) are not intended, unless otherwise specified, to be a reference to projects in any particular sector. The broad principles explored in this article can, by and large, be applied to infrastructure, transportation, energy, education, healthcare and other sectors. Likewise, references to ‘governments’ are intended to mean the relevant government and/or the relevant procuring government entities.

What is PPP?

The term ‘public-private partnership’ does not have a particular legal meaning per se. It can be used to describe a wide variety of arrangements involving the public and private sectors working together in some way. It is therefore necessary to be very clear about why the public sector is looking to partner with the private sector, what forms of PPP they have in mind and how they should articulate this complex concept.

Among the key rationale for the use of the PPP model in the context of projects are the following: the utilisation of private sector capital and expertise for the efficient procurement of government projects; more certainty for project delivery timelines and budgets; the sharing and allocation of risk as between the government and the private sector parties, to that party best placed to manage such risks; and the easing of governments’ balance sheets and the freeing of capital to be directed towards other needs.

As the name suggests, PPPs are considered a partnership (in the broadest sense) between governments and the private sector, not a divestment of responsibility. While the government retains overall responsibility for delivering the particular service, the means and responsibility for such delivery are passed to the private sector. The government retains control over the means of delivery by way of intricate and detailed payment and performance mechanisms.

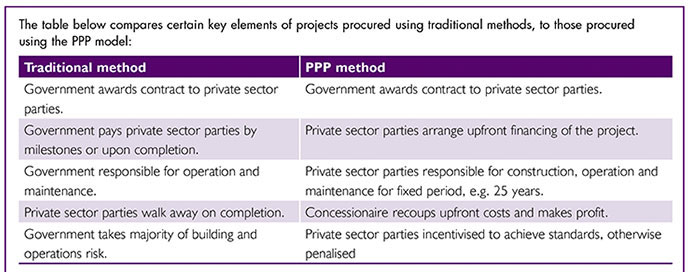

|

|

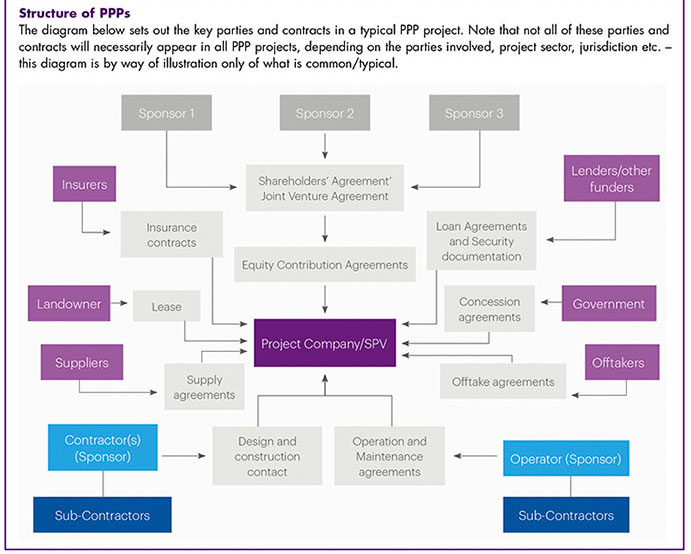

In order to better understand the purpose and objectives of PPP projects, it is helpful to understand the broad role of the major parties and documents in a typical PPP project. These are:Government The government, as the procurer of the project, is obviously a very central figure in any PPP arrangement. The contract which underpins the relationship between government and private parties (which usually act through a special purpose vehicle or special purpose company (SPV) incorporated by the sponsor(s)) is usually a concession agreement and/or an offtake agreement. A concession agreement would be used, for example, in a road project, and sets out the rights, responsibilities and risk allocation for each party and will also set out the basis upon which the SPV will generate its revenues (usually either through availability payments from the government or the right to charge tolls for use of the road). An offtake agreement would be used, for example, for an energy project, and is a long-term agreement whereby the government entity agrees to make payments to the SPV over the life of the contract for the relevant output such as water or electricity (usually through capacity and output payments). As the government has a strong interest in delivery of the project, on time and to the requisite standard, it is common for it to have step-in rights under the relevant agreement(s) in the event the project is not implemented correctly. These step-in rights supplement various other performance controls and penalties agreed between the parties. Generally speaking, it will also be the government which is responsible for procuring the project site which would be leased or licensed to the SPV for the period of construction and operation.Private parties/sponsors The sponsor(s), acting through an SPV, are the government’s main, and usually only, counterparty to the concession agreement and/or offtake agreement (although the lenders will usually have an indirect interest through a direct agreement). The SPV bears responsibility for the design, financing, construction, operation and maintenance of the project, although, apart from financing, many of such responsibilities are commonly passed down to contractors and operators (who are often the sponsor(s) themselves or their affiliates) and/or their subcontractors. Lenders Risk allocation in PPPs 2. Force majeure risk – This is the risk of occurrence of events beyond the control of both parties and which prevents either party from performing its obligations. This risk is generally shared between the parties; however, to the extent any such risks are capable of being insured against, they are often excluded from the list of force majeure events. 3. Market demand or volume risk – This risk relates to a situation where the forecast demand for use of a particular facility (or the outputs of a facility) is not met. This is a common risk, for example, in relation to toll roads, where alternative roads or methods of transport can act to reduce demand for the toll road. The allocation of this risk will often depend on the revenue model for the project. Where the private parties’ revenue is based around user-pays charges (such as toll charges for a road), this risk is usually allocated to the private party. However, where the revenue model is on the basis of availability payments, the risk lies with the government as it is required to continue making payments so long as the facility is operational (at appropriate standards). 4. Design/output – This relates to the risk that the capacity or output or performance of the project facility may not meet the agreed design criteria or project specifications. This risk is typically allocated to the private party and can be mitigated through a clear regime in the concession/offtake agreement setting out the required technical parameters (or minimum functional specifications) and performance criteria or standards and a detailed oversight/monitoring mechanism and penalty regimes for failure to meet such parameters, criteria and standards. 5. Finance risks – That is the availability of financing to develop a project, interest rates, inflation and foreign exchange risks that are usually allocated to the private party, although in some emergency markets with a nontransferable currency, the foreign exchange risk (or a part of it) will be assumed by the government. 6. Cost overrun risk – This risk relates to the cost of a project overrunning projected amounts and is firmly allocated to the private party. The private party will usually seek to substantially mitigate this risk by arranging a fixed price lump sum construction contract. 7. Political risk – This risk is of particular importance in the GCC and Africa. It relates to the taking of action by a government which negatively impacts on private parties’ ability to complete and/or operate a project. It generally covers matters including acts of war or other conflict, the imposition of sanctions, blockades or embargoes and failures to issue or renew consents required for a project. To the extent the loss or inability to perform obligations is due to the actions of the government, the risk lies with the government. |

Challenges for PPPs in the GCC and Africa For all the indications that a move towards greater use of the PPP model in the GCC and Africa is a big step in the right direction, it is without doubt that there will be various challenges for investors and governments alike to be mindful of and to address going forward. A few of the key challenges are summarised in the following key categories:Political – Aside from civil unrest, there are other elements within the wider political landscape which can hinder investor confidence in the region. These include a lack of transparency and accountability, risk of changes in laws and regulations, potential corruption and public perception in relation to the aforementioned. These issues (or, at least, perception of such issues) are particularly prevalent across Africa where allegations of corruption have plagued many projects, although investors who have experience in the region well understand such issues.Financial – At the heart of any investor’s interest in projects is its ability to generate revenue, protect such revenue and repatriate such revenue to their home jurisdiction. It will therefore be important that matters such as foreign exchange risk and transferability risk are adequately provided for in any PPP legal framework which is established. Governments will also need to strongly consider offering sovereign guarantees, bearing in mind investors’ and lenders’ long-term commitment to projects which can have a lifespan of 30+ years. In most countries, long-term PPP projects simply will not be bankable without such sovereign guarantees. Legal – Although there are clear signs supporting the view that robust PPP legal frameworks are being looked at seriously within the GCC and in parts of Africa, we are some way away from being able to point towards legal frameworks which meet international standards. It is without doubt that there is general acceptance that operating within these regions carries certain legal risks. Despite this, in the case of PPPs, private investors will seek the comfort of sound legal platforms for PPPs when determining whether to partner with governments and invest in a particular market. Future prospects for PPP projects Conclusion Although the concept of PPP projects, when simplified, appears to be a ‘win-win’ for all parties involved, it has become clear that there is a process which emerging markets will need to undertake before the model can be as successful as it has been in other more sophisticated markets. As with most things new, the process will involve an element of trial and error until all stakeholders are comfortable that the model and its implementation are stable. Structural stability of the PPP legal framework has been identified by investors and lenders as being high on the agenda for renewing confidence in investment. So while new projects are constantly being announced and coming to market across the GCC and Africa, it would seem that those able to demonstrate a bedrock of a robust PPP framework and structure will be better placed to attract interest. |

To view the full article Click Here

E: neil.cuthbert@dentons.com

atif.choudhary@dentons.com

W: www.dentons.com