By Deepa Vallabh, Nicholas Gangiah and Riola Kok,

By Deepa Vallabh, Nicholas Gangiah and Riola Kok,

E: deepa.vallabh@cdhlegal.com

E: nicholas.gangiah@cdhlegal.com

E: riola.kok@cdhlegal.com

Private equity (PE) as an asset class is a very attractive prospect for investors, due to its ability to generate returns in environments where traditional investment strategies provide lower returns due to the unpredictability of the markets.

Private equity (PE) as an asset class is a very attractive prospect for investors, due to its ability to generate returns in environments where traditional investment strategies provide lower returns due to the unpredictability of the markets.

Investment potential in Africa

PE across Africa has grown substantially over the past eight years, due to the continuous commitment of development finance institutions (DFIs) and both local and international development banks. In a statistic released by the African Private Equity and Venture Capital Association, for the period 2011 to 2016, a total of US$6.5 billion had been raised for PE in Africa, with a total reported deal value over the same period of US$22.7 billion for 919 deals. In 2016 alone, 145 deals were reported, totalling US$3.8 billion. These figures show that despite the numerous challenges associated with investing across the continent, African PE continues to present attractive investment opportunities.

According to reports published by the UN, the global population is expected to increase to 9.6 billion people by 2050, raising international concerns as to possible food shortages in the future. The UN estimates that by 2030 the global food demand will have increased by 50 percent, increasing the need for greater food production. Africa is in a unique position to mitigate the possible crisis and to develop and grow in the process. The continent holds around 50 percent of the world’s uncultivated arable land. An estimate by the World Bank in 2013 revealed that if African farmers and agricultural businesses could develop and fully utilise the uncultivated arable land available, Africa could produce a trillion-dollar food industry by 2030 as compared to the US$313 billion recorded in 2010.

In addition to arable land and the mineral wealth often spoken about in relation to Africa, the social conditions and to some extent the changing political landscape and democratisation of Africa make the continent prime for private equity investment. Africa’s attractiveness for PE practitioners stems largely from favourable population growth trends, a steady increase in disposable income, diverse and expanding economies, and an expanding middle class. The middle class in Nigeria, currently the fastest-growing economy on the continent, grew by 600 percent during the period between 2000 and 2014, with the corresponding growth rate in Nigeria for this period being an average of 4.5 percent each year.

Investments in Africa so far have predominantly been in the commodity sector, which in recent years has been in crisis. However, many countries have moved towards increased manufacturing and the development of technological, banking and other service industries. The move towards a consumer-driven economy will be supported by the fact that Africa has the youngest population in the world, with the median age in Niger as low as 15. The World Bank estimates that the population age demographic in Africa could generate between 11-15 percent GDP growth between 2011 and 2030. In addition, according to the World Economic Forum, if sub-Saharan Africa is able to take advantage and provide adequate education and jobs to its youth, US$500 billion a year can be contributed to the regional economy for 30 years. This is the equivalent of one-third of Africa’s GDP at present.

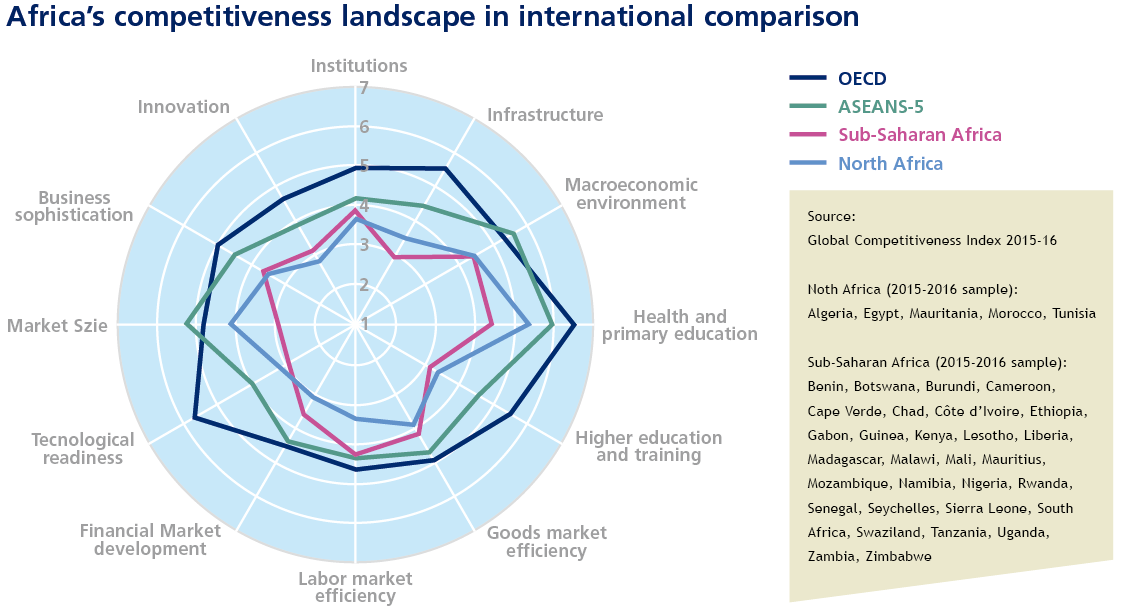

The underdevelopment in Africa as well as the smaller economic base in the developing world present greater opportunities for private equity investors and larger returns than those in developed and well-established economies. The growth trajectory of Africa when compared to other regions is promising as evidenced in the comparative diagram below published by the World Economic Forum. Paul Collier, co-director at the Centre for the Study of African Economies at Oxford University estimates that various African nations, such as Kenya, Rwanda, Tanzania and Ethiopia, have the potential to double their economies over the next decade, with many countries averaging a growth rate of between 6 percent and 7 percent during the past few years.

Africa’s share of global trade is just 3 percent, which is inconsistent with its growth trajectory, natural resources, consumer markets and growing economies of scale. What Africa lacks is the capital to maximise on these major development opportunities. Despite the projected growth trends, investment in Africa remains fairly homogenous, with countries such as China monopolising trade and investment in the continent, accounting for almost 60 percent of the trade and investment in countries such as Gambia, Gabon and Mali. According to the Private Equity Institutional Investor Trends Survey 2017, published by Probatis Partners, 55 percent of all money raised through private equity is invested in North America, which remains the largest private equity market in the world. In addition, although funding through sovereign wealth funds has increased globally, with US$7.4 trillion of assets under management in 2017, less than 10 percent of the assets held globally are assets within the African continent. This suggests that the market for private equity funding and sovereign wealth funding in Africa is largely unexplored and underfunded.

Challenges to investing in Africa

There are however a number of challenges faced by PE investors in Africa, such as uncertain economic and political environments, foreign currency shortages, exchange rate volatility, cyclical commodity-exposed businesses and the lack of infrastructure in most African counties.

Infrastructure remains one of the primary challenges to investing in Africa. Roads and railway lines are often sparse, outdated and insufficient. The lack of infrastructure in Africa has had adverse consequences for the agricultural sector, with up to 50 percent of African fruit and vegetables spoiling before reaching markets due to the lack of proper storage and the outdated means of transportation. Despite recent technological developments, there remains a soft infrastructure deficit in Africa. Barring South Africa, the data and information critical to the decision-making of businesses such as credit and risk data, consumption patterns and other related market data are either non-existent or inaccessible. Exit routes are also slightly limited for PE fund managers, due to the lack of developed stock exchanges.

Deal sourcing on the African continent is also directly impacted by the physical location of fund managers. The majority of PE funds have their headquarters elsewhere in the world and as such this results in multiple trips by PE fund managers to target countries. This leads to an increased spend on deal origination per deal, which can lead to an overall higher transaction cost per deal for funds investing in Africa in comparison to investments in developed markets. Furthermore, numerous mid-cap companies in Africa (market cap between US$80 million and US$800 million) are still being run by the founders or their families, thus making them reluctant to relinquish control to new investors.

Deal sourcing on the African continent is also directly impacted by the physical location of fund managers. The majority of PE funds have their headquarters elsewhere in the world and as such this results in multiple trips by PE fund managers to target countries. This leads to an increased spend on deal origination per deal, which can lead to an overall higher transaction cost per deal for funds investing in Africa in comparison to investments in developed markets. Furthermore, numerous mid-cap companies in Africa (market cap between US$80 million and US$800 million) are still being run by the founders or their families, thus making them reluctant to relinquish control to new investors.

However, despite these challenges, there seems to be a more positive outlook to private equity investment in Africa. The number of active fund managers in Africa continues to grow and, coupled with the steady growth across the continent, this has led to increased competition for investment targets. The current PE environment in Africa indicates that there is a high demand for quality assets and a need to maximise returns from portfolio companies. In a recent study conducted by Deloitte, a majority of the respondents across Africa are expecting increased PE activity throughout the continent in the next year. Economies that actively promote export and economic diversification will become the market leaders on the continent, with East Africa projected to show some of the strongest growth in the coming years. Attitudes towards investments in Africa are changing. The majority of the respondents who participated in Deloitte Africa’s Private Equity Confidence Survey were very optimistic and predict that PE activity across the continent will increase during the next 12 months, with most activity expected to take place in West Africa. Competition for new investments is expected to increase particularly in East and West Africa due to the high demand but limited supply of high-quality assets.

Solutions to increase investment

The risks associated with private equity funding in Africa can be managed and mitigated by investors diversifying their portfolios, investing in projects that deliver returns in foreign currency denominations as well as diversification of investments across sector, countries, managers and assets in order to spread their risk across sectors, portfolios and regions.

Investors must change their strategies to private equity funding in Africa. The approach to private equity funding often employed in developed regions is to target large deals with established management structures. However, these deals are far less common in Africa than they are in North America and Europe, and thus the approach to private equity funding in Africa must differ for investors to maximise the investment opportunities on the continent. Private equity funders must explore new investment strategies. This includes investing in smaller deals, partnering with local investors, government entities and local sovereign wealth funds. It is also imperative that private equity funders are able to secure a majority stake in investments to effectively manage the growth trajectory. Some strategies often require a parallel investment in areas that are critical to business success. For example, ensuring regular supply of electricity to a manufacturing plant where electricity supply is scarce or irregular may require investment in an alternative power supply such as renewables.

One of the key aspects to increasing value in target assets is for businesses who seek private equity investment for growth to ensure that they are managed and controlled in a transparent manner. Reporting on the basis of globally accepted accounting principles is key, together with ensuring that legal risks such as contract management and compliance are in place and in order.

One of the key aspects to increasing value in target assets is for businesses who seek private equity investment for growth to ensure that they are managed and controlled in a transparent manner. Reporting on the basis of globally accepted accounting principles is key, together with ensuring that legal risks such as contract management and compliance are in place and in order.

The improved corporate governance of existing private equity funds will always bring with it investor confidence. There are three key areas that need to be addressed to improve corporate governance across the continent, namely, the distinction between managers and the investors in order to ensure that managers remain impartial and that the interests of the fund are distinguished from the interests of individual investors, secondly, greater transparency as to the operations and investments of the funds and, thirdly, the strengthening of general corporate governance structures, including the establishment of advisory committees or similar oversight committees to ensure effective management and accountability. These practices increase value and unlock opportunities for investment. In Southern Africa, investors are focused on finding new opportunities, but emphasis has been placed on helping portfolio companies grow and refinance, as well as assisting companies to improve their corporate governance and management practices.

There is a gap here for active fund managers to go in with a focus on longer-term growth and optimising the value of the business for exit. This can be done by taking a hands-on advisory role in marketing and production, building routes to market, attracting and retaining professional management teams, skills transfer, advising the company’s board and improving overall efficiencies through focused interventions.

Conclusion

It is important for private equity investors to be aware that there is no single monolithic Africa into which private equity funds can invest. There are 55 fully recognised sovereign states, each with diverse political, social and economic conditions. The approach to private equity funding in Africa therefore cannot be homogenous. The unique conditions of each country must be taken into account when planning investments looking at sector-specific growth rates and the social and political conditions of each state.

As highlighted in a 2014 UN report, without jobs and economic opportunities, social stresses and unemployment could lead to unrest in many African countries owing to their young populations. The authors write: “Lack of meaningful work among young people is playing into frustration that has in some instances contributed to social unrest or unmanaged migration.” Simply put, Africa presents investment opportunities with the possibility of high returns, untapped markets and a promising growth trajectory that suggests long-term returns on investments. However, to sustain growth on the continent and harness the opportunities that the growing middle class and expanding sectors present, funding and particularly foreign direct investment is essential. The underdevelopment of many African countries as well as the lack of infrastructure essential to sustaining growth presents challenges for investors. However, the very essence of these challenges is exactly what makes Africa a continent to invest in, because they provide lucrative investment opportunities with the prospects of very high returns.

W: www.cliffedekkerhofmeyr.com

E: deepa.vallabh@cdhlegal.com

E: nicholas.gangiah@cdhlegal.com

E: riola.kok@cdhlegal.com